indiana estate tax threshold

As of 2019 if a person who dies leaves behind an estate that exceeds 114 million. 31 2012 every resident estate or trust having gross income or nonresident estate or trust having any gross income from sources within the state of Indiana exceeding the amount provided in Section 6012a3 of the Internal Revenue Code IRCcurrently 600 for.

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

Learn how to make a living trust in Indiana.

. In 2022 you will be taxed if the total of the gross assets at hand exceeds 1206 million. In Indiana if your estate is small or worth less than 50000 you may be able to avoid probate altogether. Though Indiana does not have an estate tax you still may have to pay.

The estate tax is a tax on an individuals right to transfer property upon your death. If you die without a will in Indiana your assets will go to your closest relatives under state intestacy laws. Intestate Succession in Indiana.

The federal credit for state death taxes table has a tax rate of 0 for the first 40000. The amount of tax is determined by the value of those. A capital gain rate of 15 will apply should your taxable income be at least 80000 but less than 441450 for single filers 496600 for married filing jointly or qualifying widower 469050 if you plan to file as head of.

Technically there is tentative estate tax liability for even the smallest taxable estates. The tax rate works out to be 3146 plus 37 of income over 13050. Indiana home sellers need to understand how these rate limits on capital gains taxes will affect their investment.

Indiana was the 42nd state to ratify some form of death transfer taxationThe first act was. Substantially a copy of the New York statutes of 1911 but it was also similar to the statutes of Illinois California and Wisconsin. Continue reading The post Indiana Estate Tax appeared first on SmartAsset Blog.

Indiana Restrictions on Who Can Serve as Executor. This is required only of individual estates that exceed a gross asset and prior taxable gift value of 1206 million 2412 for couples in 2022. For example a lucky grandchild who inherits 150000 would owe tax on 50000 because for Class A beneficiaries no tax is due on the first 100000 inherited.

IRS Form 1041 gives instructions on how to file. The tax rate thats applied to the taxable amount depends on both what class the beneficiary belongs to. Certain assets will simply.

The Executor must file a federal estate tax return within 9 months and pay 40 percent of any assets over that threshold. In 2010 Vermont increased the estate tax exemption threshold from 2000000 to 2750000 for decedents dying on or after January 1 2011. Residents of the state may still have to pay the federal estate tax though if their estates are worth enough.

This guide is for Hoosiers who are starting to think about their own. Of prior marriages Spouse. If the estate is valued at less than 6415500 million the taxable estate is then the total amount less the 611 million exemption amount.

First start with calculating your taxable estate. The fair market value of these items is used not necessarily what you paid for them or what their values were when you acquired them. It applies to income of 13050 or more for deaths that occurred in 2021.

The Estate Tax is a tax on your right to transfer property at your death. That means the federal government gets to collect 132 million in taxes leaving a total of 1368 million for your heirs. FEDERAL ESTATE TAX RATES Taxable Estate Base Taxes Paid Marginal Rate Rate Threshold 1 10000 0 18 1 10000 20000 1800 20 10000 20000 40000 3800 22 20000.

If an estate is worth 15 million 36 million is taxed at 40 percent. The Indiana inheritance tax became effective on May 1 1913 after 10 years of spirited debate. Indiana does not levy an estate tax.

Make a Living Trust in Indiana. The fair market value of real estate. The estate tax is tied with the lifetime gift tax exemption so if you want to give more than the annual exemption amount you can pay the tax on the gift or you can use part of your lifetime gift tax.

In 2021 federal estate tax generally applies to assets over 117 million. For instance the chart above would suggest that a. 13 rows Federal Estate Tax.

Heres how the actual calculation works. For instance if your taxable estate is 15 million then after the 117 million credit 33 million is taxable. As of January 1 2012 the exclusion equaled the federal estate tax applicable exclusion amount so long as the FET exclusion was not less than 2000000 and not more than 3500000.

In general estates or beneficiaries of deceased Indiana nonresidents are required to file an inheritance tax return Form IH-12 if the value of the transfers is greater than the exemption allowed for that beneficiary if the property transferred is Indiana real property andor tangible personal property located in Indiana. Filing a typical tax return is simple but completing one in the name of a decedents estate requires a little more work. If the estate is valued at less than 535 million the taxable liability is 100000.

The estate tax is a tax on a persons assets after death. It consists of an accounting of everything you own or have certain interests in at the date of death Refer to Form 706 PDF PDF. Second or subsequent childless spouse and children.

While the threat of estate taxes and inheritance taxes does exist in reality the vast majority of estates are too small to be charged a federal estate tax. This entire sum is taxed at the federal estate tax rate which is currently 40. The highest trust and estate tax rate is 37.

And to child children or issue of deceased children ½ personal property and title to real estate Children no spouse or parents All to children. ½ of personal property 25 of. It taxes the entire amount of the estate on estates over that 1 million threshold.

Does Indiana Have An Inheritance Tax Indianapolis Estate Planning Attorneys

Indiana Estate Tax Everything You Need To Know Smartasset

Comparing The Real Cost Of Owning Property Across The United States Property Tax Real Estate Staging Denver Real Estate

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Powerful Entry Level Engineering Resume Samples To Get Hired Engineering Resume Engineering Resume Templates Mechanical Engineer Resume

Indiana Estate Tax Everything You Need To Know Smartasset

How Do State Estate And Inheritance Taxes Work Tax Policy Center

States With Highest And Lowest Sales Tax Rates

20 Best Ideas Banking Resume Examples Check More At Http Sktrnhorn Co Banking Resume Examples Resume Examples Job Resume Samples Sample Resume

Breaking Most U S Sunscreens Would Be Banned In Europe Sunscreen Kids Sunscreen Baby Sunscreen

Merchant Banks Seek Corporate Tax Reduction In 2022 Tax Reduction Estate Tax Tax

Indiana Estate Tax Everything You Need To Know Smartasset

The Best Place To Retire Isn T Florida Best Places To Retire Retirement Locations Retirement

Dwell How Icon Is Building The 4 000 3d Printed Homes Of The Future House Design Building A House Future House

New Single Family Homes Indianapolis In Andover House Front New Homes House Styles

全美 房产税比较 夏威夷的房产税 排名倒数 购屋夏威夷网 全美房地产夏威夷房地产 夏威夷买房卖屋房投资 专业 可靠 协助您在美国夏威夷轻松置产 Property Tax Property Denver Real Estate

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Generate Leads Lead Generation Generation Entertaining

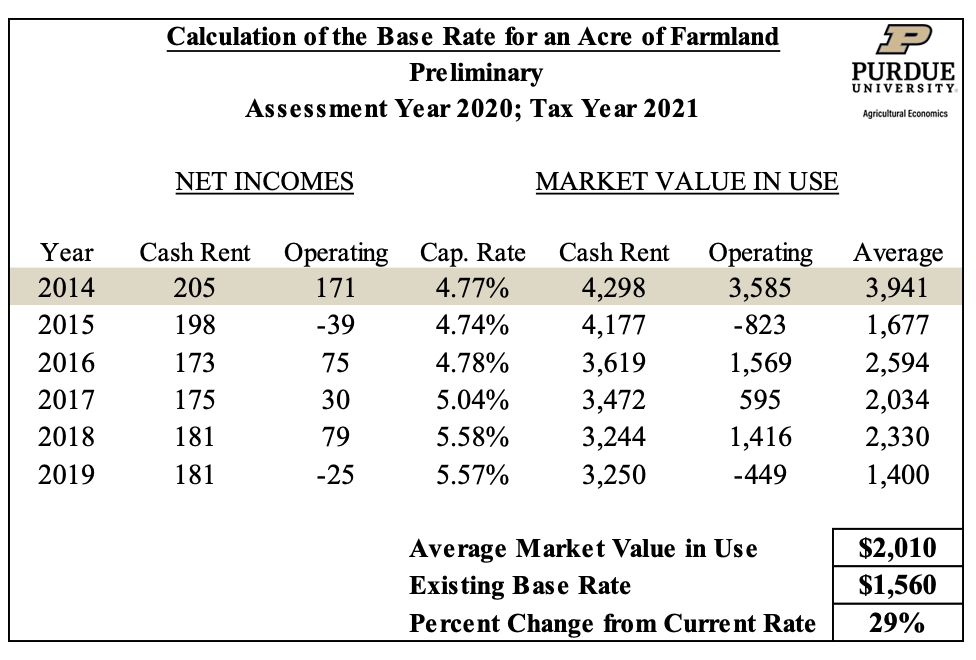

Farmland Assessments Tax Bills Purdue Agricultural Economics